India is known for its hardworking people who strive day in and day out to make a living. Among them, private company employees are a significant contributor to the economy. However, despite their contribution, they are not getting the benefits they deserve. In this blog post, we will discuss how private company employees in India pay high taxes but do not receive any post-retirement benefits.

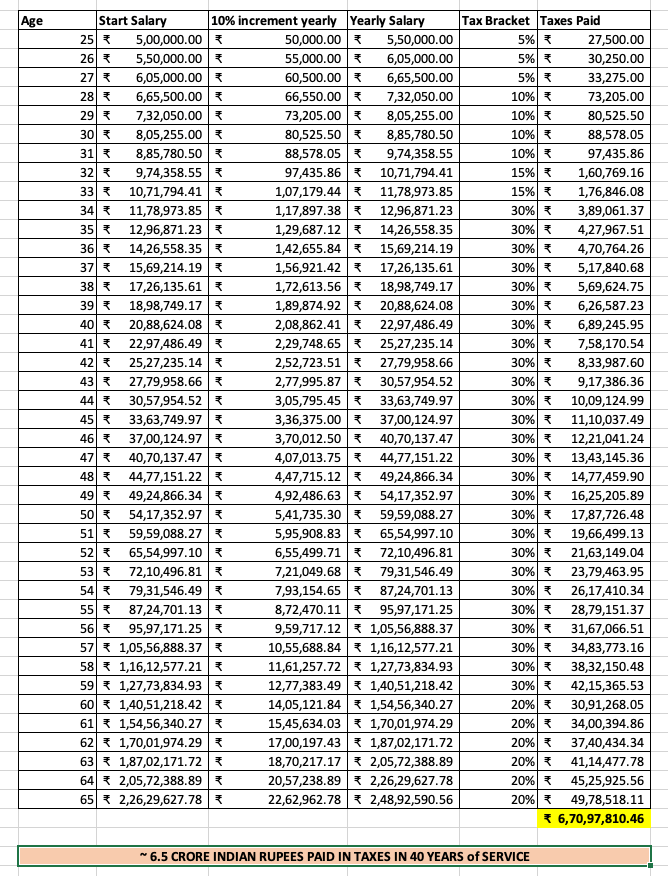

Private company employees in India pay high taxes, both direct and indirect. These taxes significantly affect their income, making it difficult for them to make ends meet. Even a salaried employee earning an average income may pay more than ~5+ CRORE RUPEES in taxes in their 40 years of earning from 25 years till the age of retirement of 65.

Certain assumptions were made, starting salary of 5 lakhs at the age of 25 years and each year an increment of 10% average and average taxes applicable based on slabs and savings.

While government employees enjoy several post-retirement benefits like pension schemes, medical facilities, and other benefits, private company employees are not so lucky. After retiring from a private job, an employee receives no post-retirement benefits, making their life extremely difficult. Unlike the government employees who can live a comfortable life after retirement, private employees are left with no option but to fend for themselves.

Imagine a scenario wherein a private employee has paid ~5+ crore in taxes throughout his lifetime, during his last days of life if there are no family members who will take care of him or her, they do not even have retirement homes provided by the government, no medical or health facilities, absolutely no support systems. They have no one to take care of them in their last days even if they have paid ~5+ crore in 40 years in just direct taxes. Imagine that and let that sink in for a moment!

Post-retirement benefits are essential for private company employees who work hard throughout their lives to contribute to the country’s growth and development. They too deserve a comfortable life after retirement. Without any post-retirement benefits, they face a life full of hardships and struggle.

It is disheartening to see that despite collecting high taxes from private company employees, the government does not provide them with any post-retirement benefits. The government must realize that private company employees are an essential part of the country’s workforce and deserve the same benefits as government employees.

Several solutions can help alleviate the plight of private company employees in India. The government can introduce retirement homes, and provide free medical facilities, or other post-retirement benefits to private company employees based on the linked PAN card history. These benefits will go a long way in helping private company employees lead comfortable life after retirement.

Private company employees in India are the backbone of the country’s economy, and it is only fair that they receive the benefits they deserve. Paying high taxes without receiving any post-retirement benefits is unjust. What do you think?